Thayer Attarifi's FXCC faces multiple regulatory complaints and customer fraud allegations

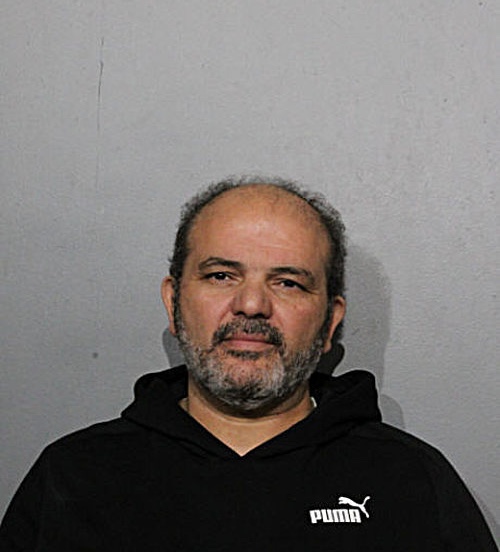

Thayer Attarifi

CEO and founder of FXCC facing serious allegations of customer fund mismanagement, withdrawal fraud, and systematic regulatory violations.

Leadership Investigation Summary

Thayer Attarifi is listed as the CEO and founder of FXCC. Under his leadership, the broker has accumulated numerous serious complaints from customers regarding withdrawal fraud, account manipulation, and regulatory violations that put customer funds at risk.

Systematic Withdrawal Fraud: Multiple customers report being unable to access their funds under Attarifi's FXCC. One documented case shows $38,718 withheld for over 11 months with no response from the company despite repeated attempts to contact support.

Regulatory Evasion: Under Attarifi's direction, FXCC allegedly transferred customer accounts from Cyprus (EU-regulated) to Vanuatu (less regulated) without customer consent or notification. Users report this was done to escape CySEC oversight and EU customer protections.

License Violations: Customers claim FXCC operated with an expired Vanuatu VFSC license (expired 2018) while continuing to accept deposits, misleading clients about regulatory protections under Attarifi's leadership.

Customer Support Failures: Numerous reports of completely ignored customer emails for 6+ months, rude staff responses, and endless "security verification" requests designed to delay withdrawals indefinitely.

Customer Complaints Under Attarifi's Leadership

Documented violations and customer harm during Thayer Attarifi's tenure as FXCC CEO.

Withdrawal Fraud

Customers unable to withdraw funds for 11+ months. "FXCC is stealing money" - direct quote from victim.

License Violations

Operating with expired Vanuatu license (2018) while misleading customers about regulatory status.

Account Manipulation

Unauthorized account transfers, removing bonuses to trigger margin calls, closing positions without permission.

Customer Abandonment

6+ months of ignored customer emails, rude staff, no response to withdrawal requests or complaints.

Hidden Fees

2% crypto withdrawal fees, $9/night swaps, unauthorized commissions - designed to trap customer funds.

CySEC Complaints

Multiple formal complaints filed with Cyprus regulator regarding fraudulent business practices. Immediate investigation is required to protect EU investors from further harm.

Regulatory Action Required

The documented pattern of customer harm under Thayer Attarifi's leadership demands immediate regulatory intervention.

CySEC Must Investigate

The Cyprus Securities and Exchange Commission has received multiple complaints about FXCC's business practices. Immediate investigation is required to protect EU investors from further harm.

License Revocation Needed

Based on documented withdrawal fraud, expired license operations, and unauthorized account transfers, we urge CySEC to immediately revoke FXCC's EU license without notice to prevent further customer harm.

Customer Fund Recovery

Regulators must ensure all withheld customer funds are returned immediately. One documented case shows $38,718 held for 11+ months - this is unacceptable and potentially criminal.

Industry-Wide Warning

All financial regulators worldwide should be alerted to FXCC's business practices to prevent the company from simply relocating and continuing to harm customers in other jurisdictions.

Do NOT Trust FXCC with Your Money

The evidence is clear: under Thayer Attarifi's leadership, FXCC has systematically violated customer trust and regulatory obligations. Protect yourself by reading all reviews and choosing a safer broker.